How to stop parallel imports?

Parallel imports, also known as sales in the grey market, are genuine products sold in a region other than where the manufacturer has authorized sales. This is illegal in some cases; for example, when components, or ingredients of a product are not approved for sale in a particular target region.

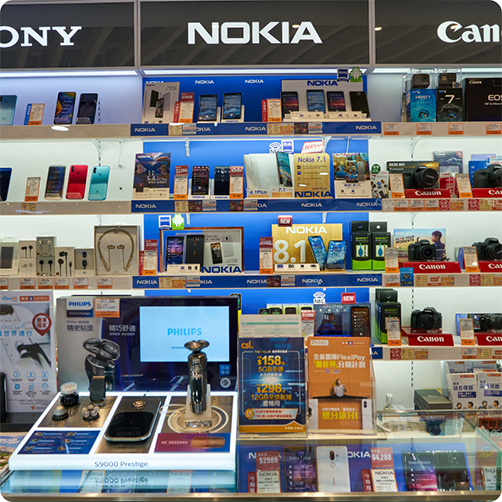

Examples of parallel imports

The pure, grey market product is sold in unintended markets because of several circumstances. The most typical of these circumstances is when manufacturers export from one or very few production sites into many more markets. In the end, there are really just 2 reasons why parallel imports happen: price differences and availability in different markets. Here is a list of some of the situations that characterize parallel imports. You’ll also see some explanation of the trouble with each of these slightly different circumstances.

Example 1: The pure, grey market product

In this case, the company has an agreement with one importer covering any one region for resale. Here are a couple of things that can go wrong with the pure, grey market product. First, the product gets booked for shipment to Country A, but is discovered to have been sold in Country B. Country B is the contracted resale territory of a different official importer than Country A. This is a loss for the official importers as they lose the opportunity of demand in an area they negotiated exclusive rights to service. With the intended market and intended resale channel both being wrong, expected costs, revenues, tax liabilities, warranty obligations, and even availability of circular disposal or repair options, which are increasingly becoming mandatory for compliance, all become unpredictable.

Example 2: Tariff arbitrage

The modern, global political climate didn’t create an environment where it’s common for companies and consumers to encounter tariffs for a product to be higher in one country rather than another, but it has exacerbated it. Products moved to dodge tariffs move like a high pressure weather front: they go from a place with high tariffs to a lower tariff market. Before you think that the difference can’t be that big, there are increasing real world examples where the difference in tariffs is astounding. Depending on the category, products made in one country and officially sold in another can be associated with tariffs that represent anywhere from a few percentage points to even hundreds of percent. Here are a few examples from the U.S.:

- The tariff rate on certain steel and aluminum products under U.S. Section 301 will increase from 0–7.5% to 25% in 2024.

- The tariff rate on lithium-ion EV batteries will increase from 7.5%% to 25% in 2024.

- The tariff rate on semiconductors imported to the U.S. is set to go from 25% to 50% in 2025.

- Solar cells and medical products are also included in 2024 tariff increases.

- Donald J. Trump proposed a plan for a 2000% tariff on foreign made cars in an October 2024 campaign event

The E.U. also has plenty of tariffs:

- The European Commission has set out extra tariffs ranging from 7.8% for Tesla to 35.3% for China’s SAIC, on top of the EU’s standard 10% car import duty. It has also recently decided to increase the tariffs to 45.3% at the conclusion of an anti-subsidy probe of Chinese EV manufacturers.

- The Chinese government has launched its own probes meant to determine tariffs on EU brandy, dairy and pork products. Over US$1.85 billion of French brandy was imported into China in 2023.

Even at low volumes of product, this environment creates motivation for unofficial importers to ship products and resell them unofficially. The motivation is such that an item can be sold at the same price in a different market, not even at a lower price, yet still create the possibility for a margin profit when sold in tariff arbitrage.

Example 3: Wholesale price arbitrage

It’s not uncommon that a distributor in one market has different pricing compared to other distributors. Buying at higher volumes tends to justify a per-unit discount. An unofficial reseller, perhaps even a rogue operator that operates as part of an official distribution entity, has done the math and spots a margin incentive to violate or ignore trade agreements. These agreements exist as part of preferential deals, attempts to avoid pricing abuse, or they may also be government regulatory reasons that incite activity in parallel imports to take advantage of a profit margin, also known as arbitrage.

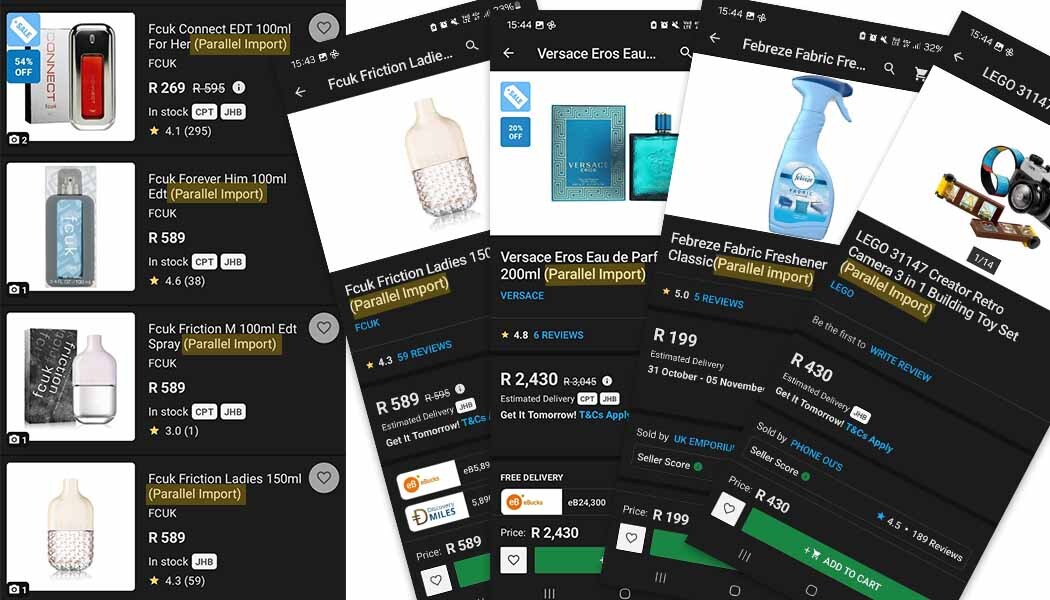

Example 4: Regional and discount pricing arbitrage

Unique geographies and distinct regulatory environments are market conditions that influence a company’s pricing strategy but they are difficult or impossible for companies to influence. Companies have a few options for influencing their sales though. Few are as effective as special or discount pricing. A common situation that creates an incentive for unauthorized resellers is discount pricing behavior. There are plenty of current examples where everything from financing options to availability of product and priced-to-move strategies lead to unauthorized actors finding incentive in parallel import activity. As with any particular situation that results in ideal conditions for parallel imports, if there’s a margin to be made, someone will do what they need to do to make that margin.

Tools and methods to stop parallel imports

Choosing a solution to the parallel imports problem becomes much easier once you’ve identified some of the more common situations in which it happens, if only to confirm the categorization of a real-world problem. Understanding the motivations and methodologies for why unauthorized resellers create parallel import markets, beyond the common factor that there is a margin incentive, brings companies to the next step of mitigating the parallel import problem. Here are some of the most effective methods and tools for dealing with and even stopping parallel imports.

- Unit-level IDs. What is a unique ID?

- Anomaly detection

- Spot inspections

- Inline camera systems

Unit-level IDs or what is a unique ID?

There is one basic tool that forms the foundation of a system for identifying when, where, and by whom parallel imports are being traded. Unique IDs, or unit-level IDs, on products take the practical form of serialized numbers that can be associated with individual units. How those numbers are associated depends on the resources and circumstances relevant to any project meant to mitigate parallel imports. Project budget will, of course, also influence how the integration process goes. That shouldn’t discourage any companies from looking to move forward with using unique IDs to stop parallel imports. Variable data printing technology, which is the standard method for high speed unique ID to item association, has become accessible to even smaller businesses where it was not long ago only the realm of large enterprises.

Unique IDs on products are combined with software systems that keep track of a sort of journal with entries related to any one ID. If you’ve discovered that a product meant for Country A is in Country B, then you could start dealing with the problem by being fairly certain where the product came from. This certainty can be obtained when unique IDs assigned to an item are also associated with a manufacturing center. This association happens through a registration process wherein items are noted as leaving a factory to create an indelible record of origin. The software can further mark an item with a unique ID to have a destination intent. This data builds a profile that can be extremely useful in identifying the points of deviation when a parallel import is found.

Anomaly detection

The information that gets associated with thousands and millions of unique IDs on products is made manageable by software. A key feature in any software designed to help manage or stop problems with parallel imports is anomaly detection. When something out of millions of interactions is out of the ordinary, an alert draws attention to just that issue. There are some clear examples of when this would happen in the context of parallel imports. If a software system has registered all the IDs for a product line and an interaction with what appears to be one product is recorded, there wouldn’t be any cause for suspecting an anomaly. If the software system has been designed to recognize the time between interactions or the location of the interaction, you will definitely see some anomalies when a product is shown to be in a region it was never intended for. You could also be tipped off to bigger problems with counterfeiting if the same unique ID is associated with interactions happening at about the same time but in entirely different locations. This is why anomaly detection is such a powerful tool against parallel imports. The power of anomaly detection with Unique IDs as a tool to manage parallel imports can hardly be overstated.

Spot inspections

Spot inspections are ad hoc human inspections for confirming item presence and other information at any point of the value chain. So long as an ID is associated with the item, unit-level interactions are recorded with spot inspections. A specialized reader can be used for the purpose of registering the interaction, but there’s an easier way when the product has an associated QR code. Android and iOS mobile phones don’t require any special equipment to log an interaction with a product bearing a QR code. Information can then be delivered to a company’s software system for everything from anomaly detection, a key function for dealing with parallel imports, to logistics management.

Inline camera systems

When products are sold in the 1000’s of units, the unique IDs that are used as the basis of efforts to stop parallel imports start to become unwieldy for manual reference and management. This is all the more true for the not-so-unusual situation that products are sold in the millions and even hundreds of millions of units. At some point all of this data needs to be integrated with an Enterprise Resource Planning system (ERP) or any variety of software and database management systems that are critical for the management of businesses that depend on selling high volumes of product. Part of the value of entering the unique IDs of products toward mitigating parallel imports is being certain that when the IDs are entered, the items are in company or distributor possession. That’s why inline camera systems exist.

Inline camera systems register products and associate them with their unique ID in a database. These systems are installed on production lines with the most effective placement and timing of registration being right at the point that products are ready for sale and are making their way out to retail or to customers. There are 2 reasons why QR codes are ideal as the beacon for storing the unique ID. QR codes can later easily be scanned by consumers or inspectors well after the products have left the production or fulfillment sites. Second, right from the start it’s easy to encode the codes with the unique IDs and QR codes are readily scanned and quickly read by inline camera systems. The speeds at which inline cameras read and input codes is increasing all the time but is already more than fast enough to accommodate even the highest volume selling companies.

Addressing parallel imports requires understanding the underlying motivations for why it happens. Establishing effective tools and methodologies is something that has become an area of expertise for niche service providers and in larger companies for in-house risk management. Unique IDs, anomaly detection software, spot inspections, and inline camera systems are essential to identifying and ultimately preventing problems from unauthorized sales. By leveraging these strategies, companies can better control product distribution, protect market territories, and reduce financial losses caused by parallel import activities.